It is my impression that the Contact Center industry indoctrinates customers to simply not expect that complex scenarios can or should be managed by CCaaS products because their platforms lack the foundation and flexibility needed to run modern Contact Centers.

As I work with different Contact Centers around the world an emerging pattern has become clear. Vendors push operational responsibilities to the agent side instead of using their software offering to optimize the workflow experienced by the agent and ROI suffers because of this.

ROI/TCO is one of those concepts that many people tend to dismiss either because it sounds foreign or it sounds like made-up concepts that in their perception, no one can wrap their arms around. The funny thing is that to a certain point, I completely understand their point of view as I also think these are overused concepts floating around our industry, with flimsy ways to explain how they are achieved. All that said, I also think that it is critical to sit down and fully understand them and assess the real ROI/TCO around any project your company tackles.

Real World Example – Insurance Industry

Consider a real world situation with a customer in the insurance industry. This customer generates and sells fresh leads for the insurance industry. There are many companies doing this in the market so to stand clear from their competition, they wanted to commit to several principles:

- Leads would not be shared with multiple organizations

- Once a lead is prequalified, the lead must be assigned to a purchasing organization live in real time. This lowers the possibility of the prospect becoming “cold” and not following up with their initial request. This effort must be accompanied by the transfer of real-time data collected during the prequalification phase

- Give the purchasing organization an ample set of criteria in order to receive/accept the live lead:

- Maximum number of daily leads to purchase

- Location of the insurance office. This facilitated assigning each lead to the closest office to the purchased lead.. There are also legal considerations as an office close to a State boundary may or may not be licensed in both States

- Hours of operations

- How many simultaneous calls can they handle to accept leads. If an organization only has 2 salespeople, it makes no difference to try to transfer 3 calls at the same time. One of the leads is going to be lost or go cold. Also, the option to simply transfer the lead data without requiring a call was offered

- Language barriers

Insurance carriers not accepted: for example an insurance carrier’s office has no use for existing customers looking to move to another insurance company.

Immediate Improvements

Initial operations were quickly improved by using a traditional approach. All calls came to a qualifying agent that would attend to the customers’ requests. Quickly it became clear that the initial set of criteria were difficult to implement in real time by an agent. So the standards were initially lowered for several reasons:

- High cost of agent training to handle the post-qualifying decision making and the high cost of replacing such agents

- Many the principles were either difficult to calculate in real time by an agent or simply just too time consuming or flat out impossible!

Even with the lower standards, a side effect quickly presented itself: Once a person was prequalified and showed interest, the lead assignment process took so long that over 60% of transferred lead callshung up before the process could be finished!

NGNCloudComm to the Rescue

We did an initial assessment and decided to take the following steps:

- Web leads would come directly from multiple sources to the Contact Center and were automatically prioritized based on “hotness” and inventory levels left for the day (how many contracted leads for the day were left to sell for each type of insurance)

- Replaced the Agent interface from a basic data screen to an Intelligent Script to walk agents through the entire qualification process, improving the flow of every call.. Average call length decreased from more than 20 minutes to just over 7 minutes! This reduced the cost per lead for our customer by 62%!

- We identified that across all the different purchasing insurance organizations in reality they used only 5 CRMs. A generic on demand data upload system was created using our CRM interface which unified the process for our customer no matter who they were selling their lead to. Transferring lead data to each purchasing agency now took seconds and could happen in real time

- Created all the Business Rules requirements inside our platform to allow the intelligent script to automatically make all assignment rules for the Agent. This was the most impactful and profitable aspect of the entire process:

- The average time it would take an agent to select the qualifying “purchasing agency” dropped fromover 10 minutes to less than 2 seconds! This virtually eliminated the number of customers that hung up tired of waiting to be transferred to an insurance agent!

- All previously dropped or decreased criteria were put back in place as they were now automatically processed by NGNCloudComm and not by agents reducing the number of misplaced leads by 42%

The average time it would take an agent to select the qualifying “purchasing agency” dropped from over 10 minutes to less than 2 seconds! This virtually eliminated the number of customers that hung up tired of waiting to be transferred to an insurance agent!

As leads reached the center, they were dialed and contacted based on the urgency to fulfill contractual obligations first. Once an agent pre-qualified a customer, all they had to do was simply click a “Transfer” button, and within 2 seconds they would seethe name, number, and information of the agency selected to receive the lead. What did NGNCloudComm process during those 2 seconds?

- Any agency that already had their quota filled for the day were eliminated

- Disqualified any existing Insurance Agency already in place by the prospect (i.e. if the prospect already had InsuranceA, those agencies also from InsuranceA were eliminated)

- Eliminated agencies with any language barrier

- Eliminated any agencies already closed for the day

- Calculated in real time the number of other active calls and eliminated those agencies that were at their maximum simultaneous call level

- Sorted the remaining agencies based on location and eliminated agencies without the proper State licensing

So within much less time than it takes to read that numbered list, the top agency was selected and presented to the agent. In that moment, the agent would perform a warm transfer to the selected agency while automatically loading the lead to the selected agency’s CRM! All this within 2 seconds!

Another “side effect” was the an 80% reduction in training needs, being able to replace agents as needed and make them operational within minutes instead of days because all the key operational decisions were automated by NGNCloudComm.

%

Work with a Partner and not Just a CCaaS Vendor

We worked with a new customer who had their legal counsel speak with their previous well known CCaaS provider about the new Florida law before it went into effect in July 2021. This vendor told them that their product had no option to ensure they could be in compliance with the new law and their advice was to stop uploading Florida leads and to stop calling any Florida phone numbers! The immediate question for them was “what do we do with all the new laws that are coming for other states, do we stop calling those also?” to which they got no answer.

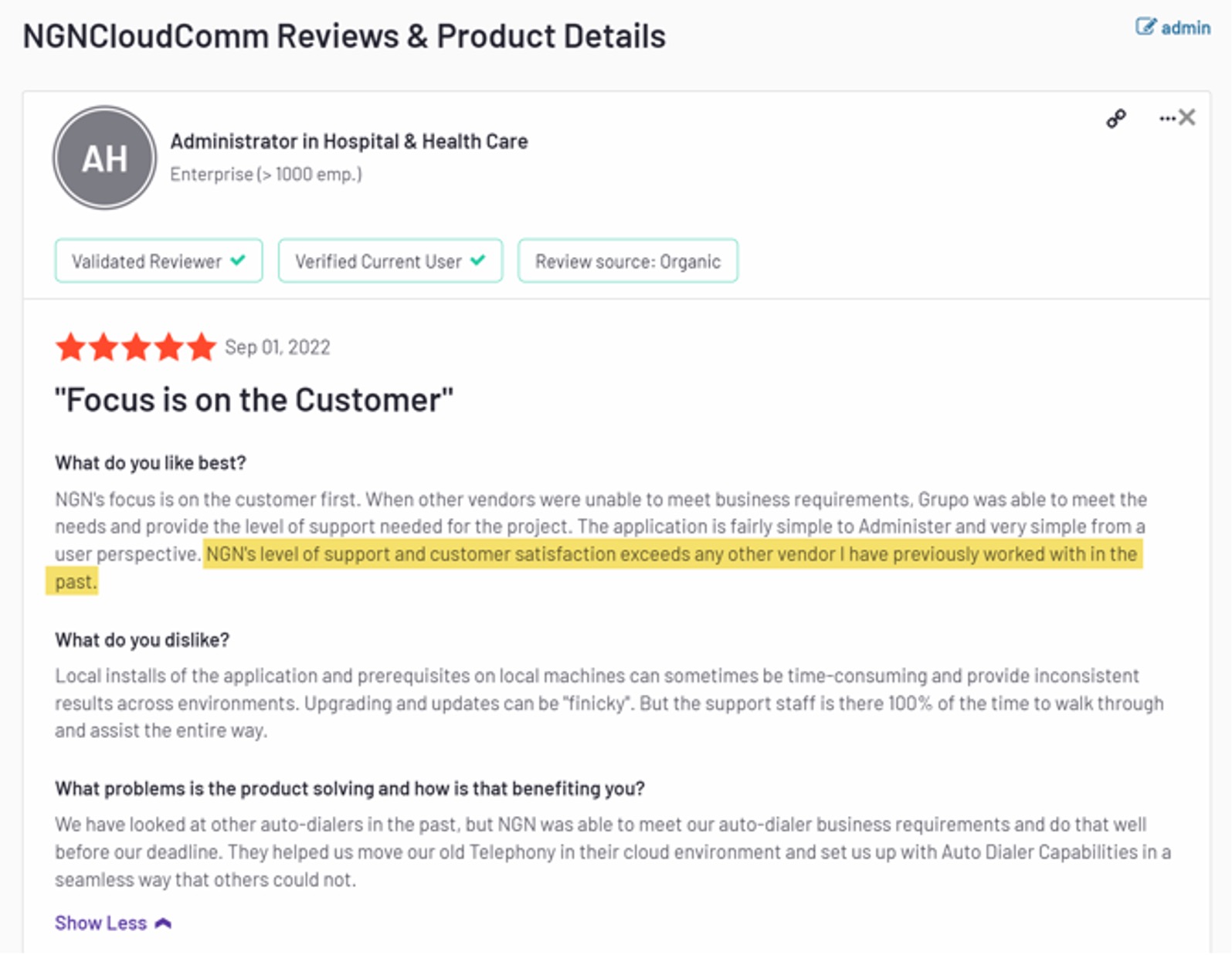

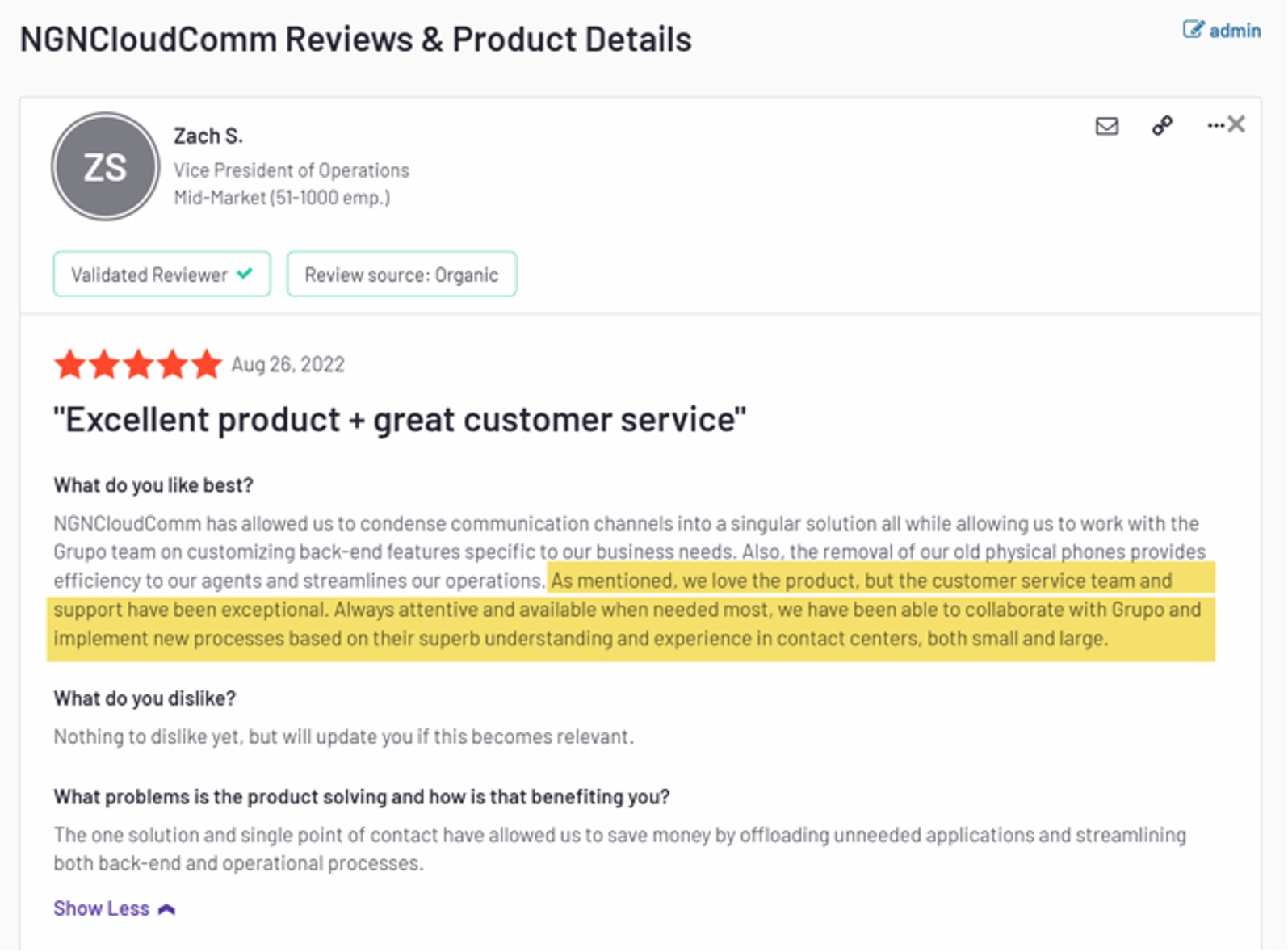

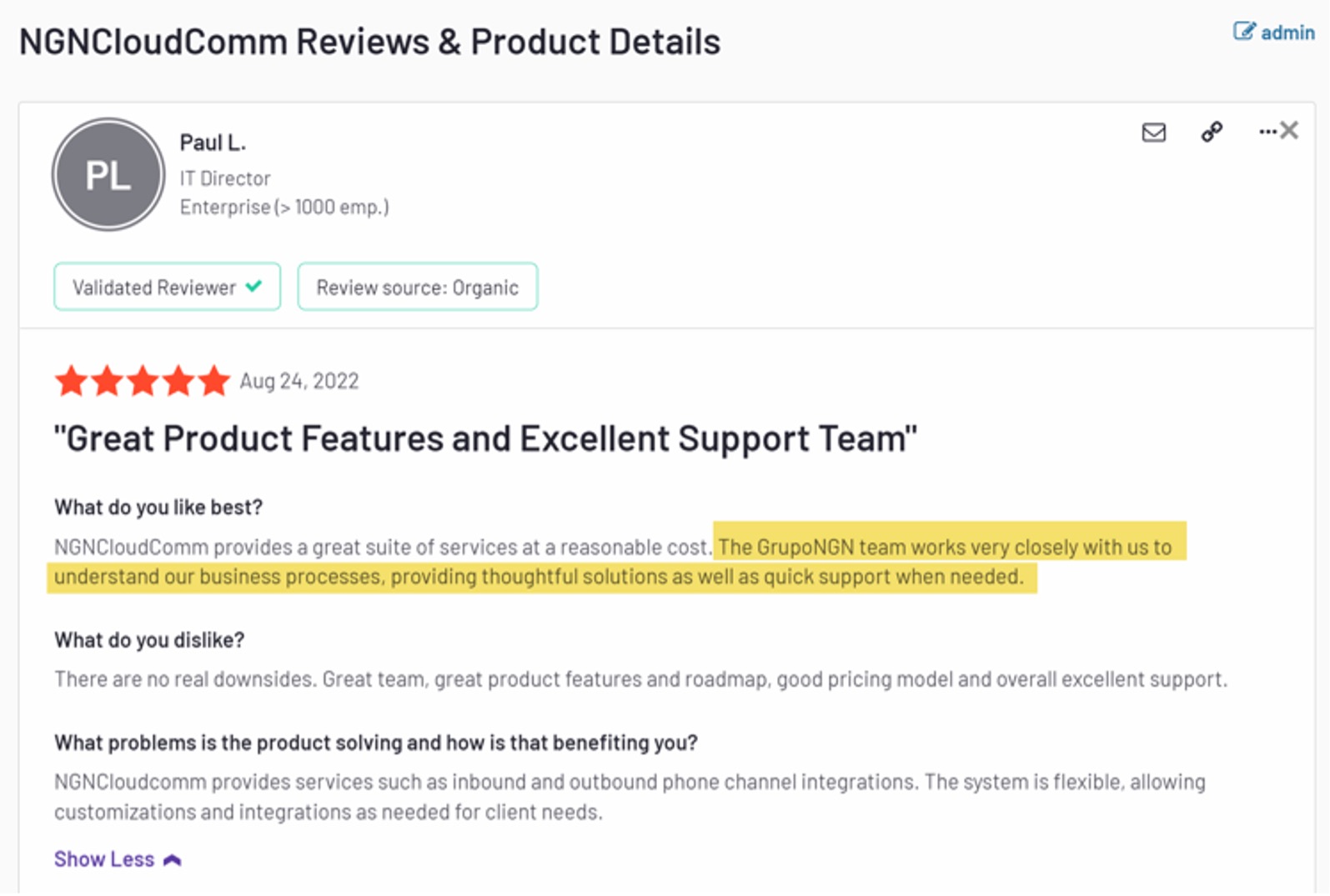

That is not how we do things at Grupo NGN where our motto is “Let Your Imagination be Your Only Limitation”. All NGNCloudComm customers have had the immediate ability to update their internal Business Rules to be compliant with every single new law that has been passed across several different states. For customers that needed assistance we provided them with fast and affordable support to update their Business Rules and Agent Scripts well before the Florida law went into effect. We like to become our customer’s “technology partner” and ensure they are 100% compliant and efficient. It is this attitude and service that has kept our customers extremely satisfied with our services and software, generating a continuous 99% 4 and 5 star customer support rating for more than 25 years! Some of our G2 reviews include:

my favorite part of working with NGNCloucomm is the level of customer service. Time after time, they have gone above and beyond. This team works harder than anyone I have ever met to ensure that our systems work optimally and that every last one of our needs is met.

As mentioned, we love the product, but the customer service team and support have been exceptional. Always attentive and available when needed most, we have been able to collaborate with Grupo and implement new processes based on their superb understanding and experience in contact centers, both small and large.