FTC TSR Rules and Call Center Considerations

Disclaimer: Please note that the Federal Trade Commission (FTC) Telemarketing Sales Rule (TSR) applies to Contact Centers engaging with U.S. residents. The views and statements presented by Grupo NGN and its personnel should not be construed as legal advice. We strongly urge clients to seek independent legal counsel for a comprehensive evaluation of their Contact Center operations.

Call Abandonment (and Safe Harbor) According to the FTC.gov website

Under the TSR’s definition, an outbound telephone call is “abandoned” if a person answers it and the telemarketer does not connect the call to a sales representative within two seconds of the person’s completed greeting. The use of prerecorded message telemarketing, where a sales pitch begins with or is made entirely by a prerecorded message, violates the TSR because the telemarketer is not connecting the call to a sales representative within two seconds of the person’s completed greeting.

The abandoned call safe harbor provides that a telemarketer will not face enforcement action for violating the call abandonment prohibition if the telemarketer:

Uses technology that ensures abandonment of no more than three percent of all calls answered by a live person, measured over the duration of a single calling campaign, if less than 30 days, or separately over each successive 30-day period or portion thereof that the campaign continues.

Allows the telephone to ring for 15 seconds or four rings before disconnecting an unanswered call.

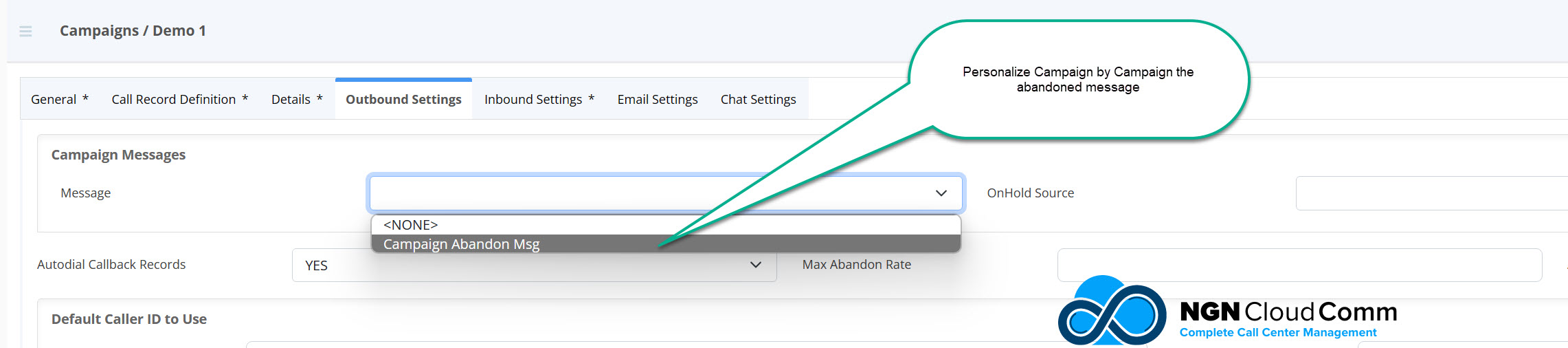

Plays a recorded message stating the name and telephone number of the seller on whose behalf the call was placed whenever a live sales representative is unavailable within two seconds of a live person answering the call.

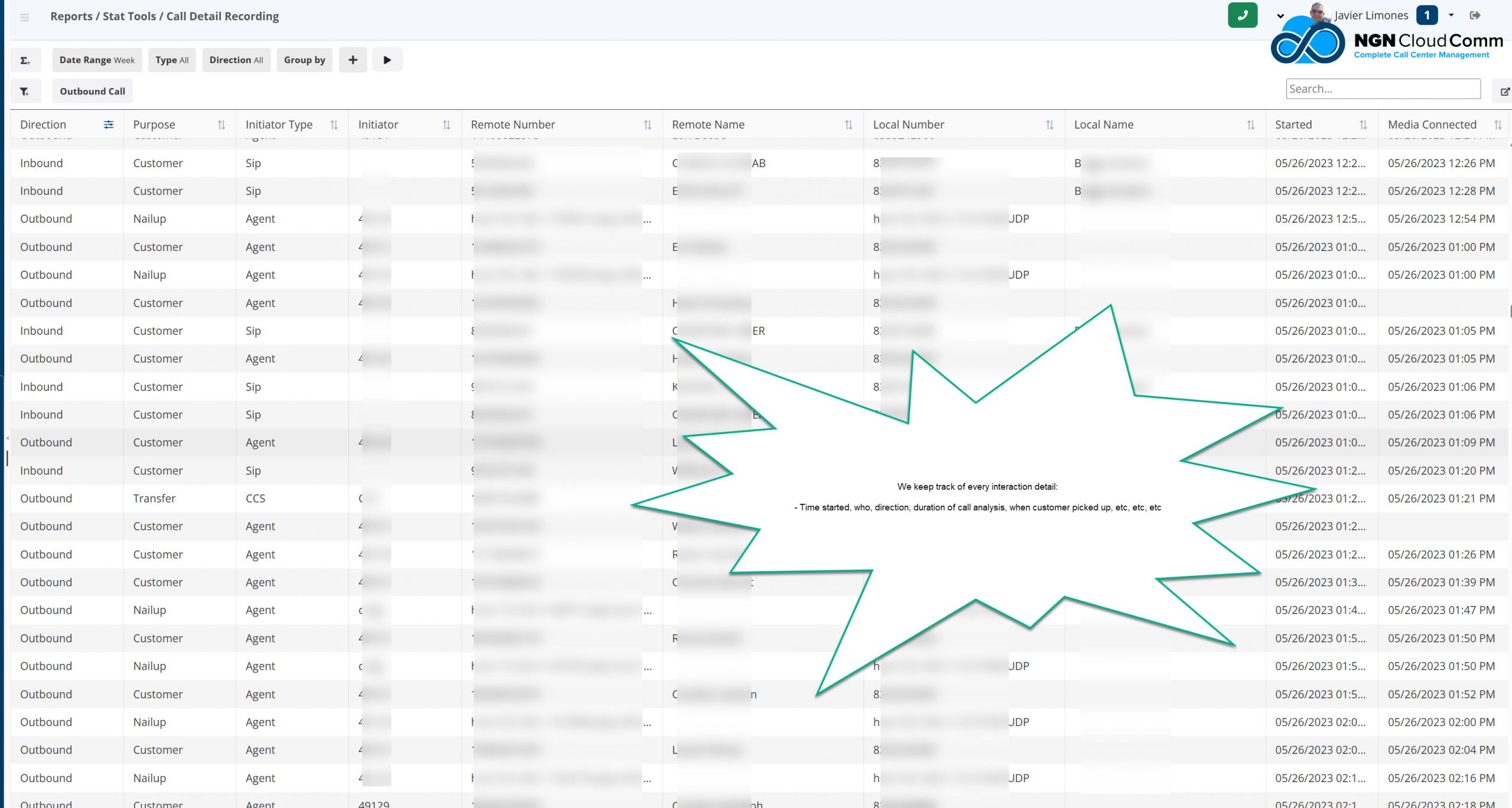

Maintains records documenting adherence to the three requirements above.

In order to take advantage of the safe harbor, a telemarketer must first ensure that a live representative takes the call in at least 97 percent of the calls answered by consumers. Calls answered by machine, calls that are not answered at all, and calls to non-working numbers do not count in this calculation. (Note that calls that are answered by machine and that deliver prerecorded messages raise other concerns. See “Telemarketing Calls That Deliver Prerecorded Messages.”)

FTC.GOV

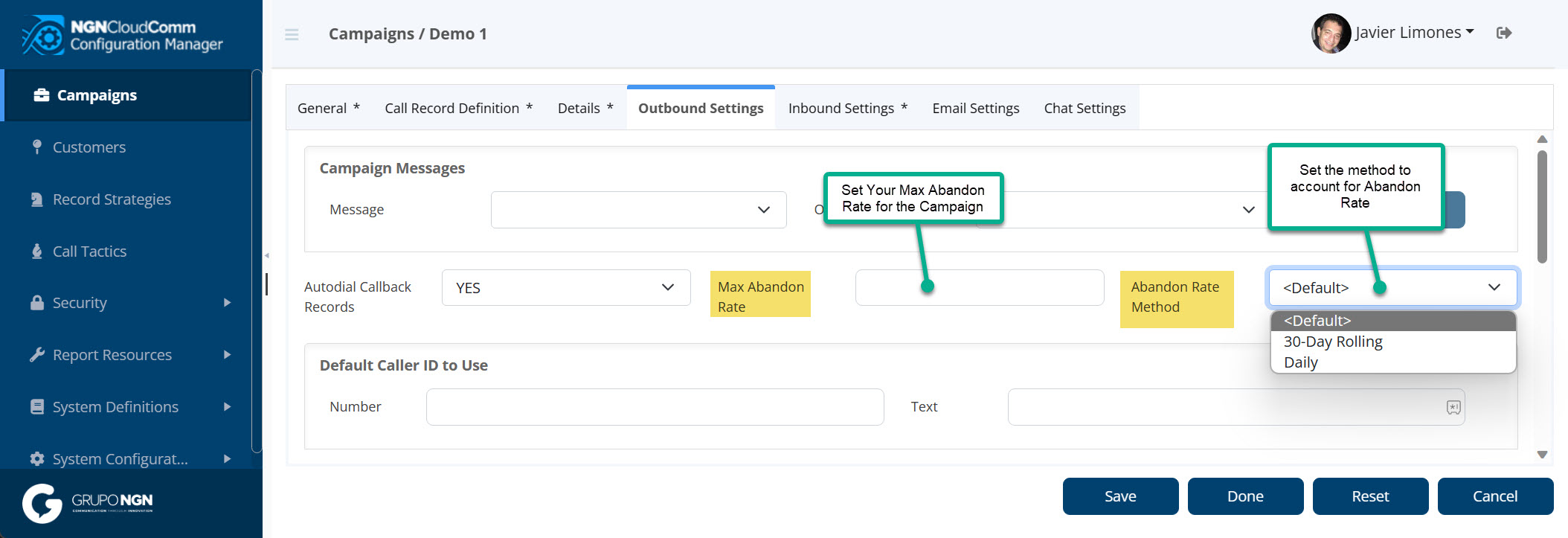

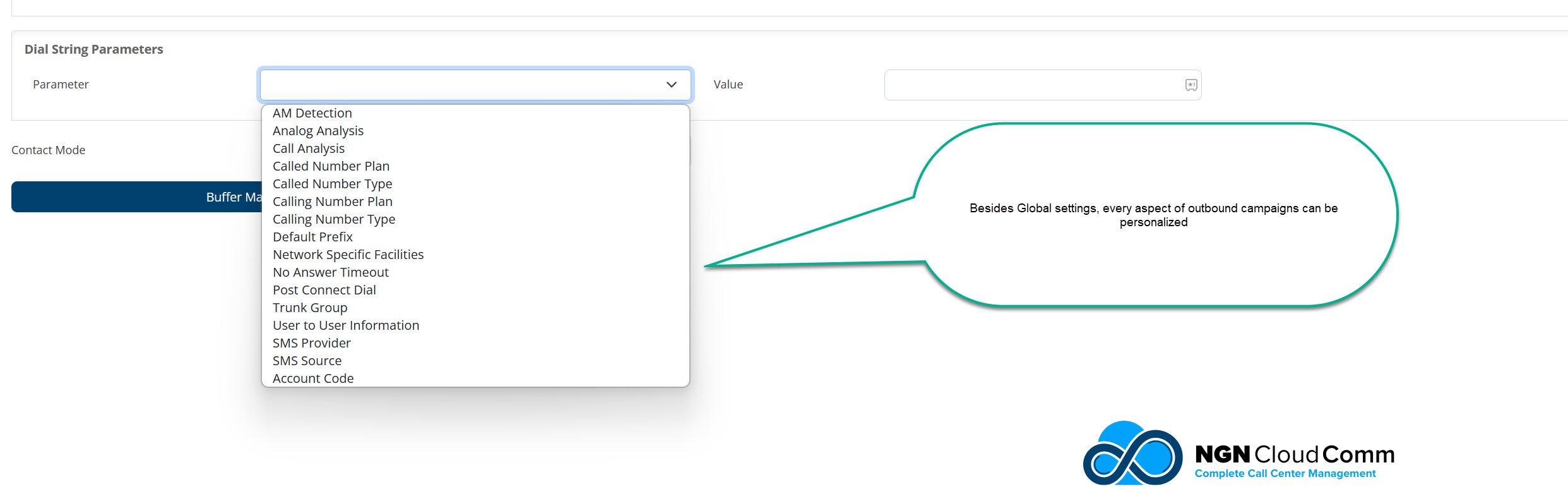

How does NGNCloudComm handle FTC Call Center TSR Rules?

The FTC further clarifies that in order to take advantage of the safe harbor, a telemarketer must first ensure that a live representative takes the call in at least 97 percent of the calls answered by consumers. Calls answered by machine, calls that are not answered at all, and calls to non-working numbers do not count in this calculation. (Note that calls that are answered by machine and that deliver prerecorded messages raise other concerns. See “Telemarketing Calls That Deliver Prerecorded Messages.”)

From The Consumer Financial Protection Bureau

Telephone Call Frequency: Presumptions

- What are the presumptions related to telephone call frequency?

Under the Debt Collection Rule, a debt collector is presumed to comply with the prohibition against repeated or continuous telephone calls or conversations if the debt collector places a telephone call to a particular person in connection with the collection of a particular debt neither:

- More than seven times within seven consecutive calendar days [“call frequency prong”]; nor

- Within a period of seven consecutive calendar days after having had a telephone conversation with the person in connection with the collection of such debt [“conversation frequency prong”].

For the presumption of compliance to apply, the debt collector must not exceed either prong of the standard.

12 CFR § 1006.14(b)(2)(i).

Conversely, a debt collector is presumed to violate the prohibition against repeated or continuous telephone calls or conversations if the debt collector places a telephone call to a particular person in connection with the collection of a particular debt:

- More than seven times within seven consecutive calendar days [“call frequency prong”]; or

- Within a period of seven consecutive calendar days after having had a telephone conversation with the person in connection with the collection of such debt [“conversation frequency prong”].

The presumption of a violation applies if the debt collector exceeds one or both prongs of the standard.

consumerfinance.gov

How does NGNCloudComm handle this?

NGNCloudComm has a sophisticated “Business Rules” module. With our “Business Rules” module it is simple to add these rulings or more sophisticated ones into the system. And it can be controlled system-wide or campaign by campaign basis to preclude that any user can violate any law whether the rule is internal, Statewide or Federal.